Learn more about Alert Innovation Chief Technology Officer and Co-Founder, Bill Fosnight, our disruptive technology, and our future with Walmart.

Author: Monique MacGillivray

The Alphabot System dramatically improves e-Grocery order fulfillment and provides significantly enhanced capability versus other goods-to-picker technologies. An Alphabot-powered micro-fulfillment center can:

– Reduce human error and maximize labor utilization with robot powered system

– Induct store-picked order totes and automatically consolidate each order for dispensing to customer

– Store items and completed orders in three temperature zones: ambient, refrigerated, and frozen for reliably and safely storing food

Learn more about the Alphabot System.

A Walmart employee loads up a robotic warehouse tool with an empty cart to be filled with a customer’s online order at a Walmart micro-fulfillment center in Salem, NH. on Jan. 8, 2020.

Boston Globe | Boston Globe | Getty Images

When the economy slows down, the classic response for consumer businesses is to cut back: slow hiring, maybe lay off workers, slash marketing, or even slow the pace of technology investment, delaying projects until after business has picked up again.

But that’s not at all what America’s troubled retail sector is doing this year.

With the S&P Retail Index down nearly 30% this year, most of the industry is boosting investment in capital spending by double digits, including industry leaders Walmart and Amazon.com. Among the top tier, only struggling clothier Gap and home-improvement chain Lowe’s are cutting back significantly. At electronics retailer Best Buy, first-half profits fell by more than half – but investment rose 37 percent.

“There is definitely concern and awareness about costs, but there is a prioritization happening,” said Thomas O’Connor, vice president of supply chain-consumer retail research at consulting firm Gartner. “A lesson has been taken from the aftermath of the financial crisis,” O’Connor said.

That lesson? Investments made by big-spending leaders like Walmart, Amazon and Home Depot are likely to result in taking customers from weaker rivals next year, when consumer discretionary cash flow is forecast to rebound from a year-long 2022 drought and revive shopping after spending on goods actually shrank early this year.

After the 2007-2009 downturn, 60 companies Gartner classified as “efficient growth companies” that invested through the crisis saw earnings double between 2009 and 2015, while other companies’ profits barely changed, according to a 2019 report on 1,200 U.S. and European firms.

Companies have taken that data to heart, with a recent Gartner survey of finance executives across industries showing that investments in technology and workforce development are the last expenses companies plan to cut as the economy struggles to keep recent inflation from causing a new recession. Budgets for mergers, environmental sustainability plans and even product innovation are taking a back seat, the Gartner data shows.

Read the full article on CNBC.

This is an excerpt of an article published by McKinsey & Company. Read the full article here.

Investing in the right configuration of picking and handling as well as delivery capabilities holds the key to upending the current economics in online grocery.

The explosive growth in North American online grocery presents a vexing challenge for retailers. While the need to serve this channel is obvious, achieving profitability continues to be a challenge. In the meantime, consumers have gotten used to the convenience of delivery—the faster, the better. Grocers are under rising pressure to meet these ever-increasing expectations and mitigate online grocery’s dramatic impact on order economics.

To serve online demand without significantly cutting into margins, executives must focus their investments on the two major drivers of online fulfillment cost: handling and delivery. Grocers can manage these drivers by selecting from a range of fulfillment and delivery models. The right solution varies depending on a region’s demographics and population density and is also shaped by the target customer value proposition. Organizations that navigate these options wisely will be better positioned to grow profitably.

Online is here to stay, and consumers are more demanding than ever

Online grocery penetration has grown steadily over the past several years but was greatly accelerated by COVID-19. According to a recent McKinsey consumer survey, some trends that took hold during the pandemic will likely endure and even deepen:1

The online channel continues to show strong growth. Online and delivery orders rose by about 50 percent during the pandemic and are expected to increase two to five percentage points in 2022, depending on the delivery option.

Consumers increasingly want delivery rather than click and collect. For online grocery shoppers, click-and-collect offerings have been supplanted by home delivery. According to our survey, 63 percent of online grocery shoppers in December 2021 preferred home delivery to click and collect, up from 48 percent a year earlier. Consumers are particularly gravitating toward same-day and instant delivery. The latter increased 41 percent over the course of the pandemic and is expected to rise further in 2022, with a net two percentage points of survey respondents expecting to increase their use of instant delivery.

Personal contact continues to decrease in importance. Before the pandemic, 46 percent of consumers preferred personal contact in stores. The past two years have muted its importance: now just 31 percent value this type of engagement.

Convenience trumps all. Consumers were drawn to online shopping for its convenience and relative safety during the pandemic, and our survey suggests shoppers have embraced these benefits and aren’t interested in returning to the prepandemic normal.

As these insights reinforce, even grocers that rapidly adapted their operations early in the pandemic have no time to rest; they must continue to keep pace with evolving consumer preferences.

Read the full article on McKinsey & Company.

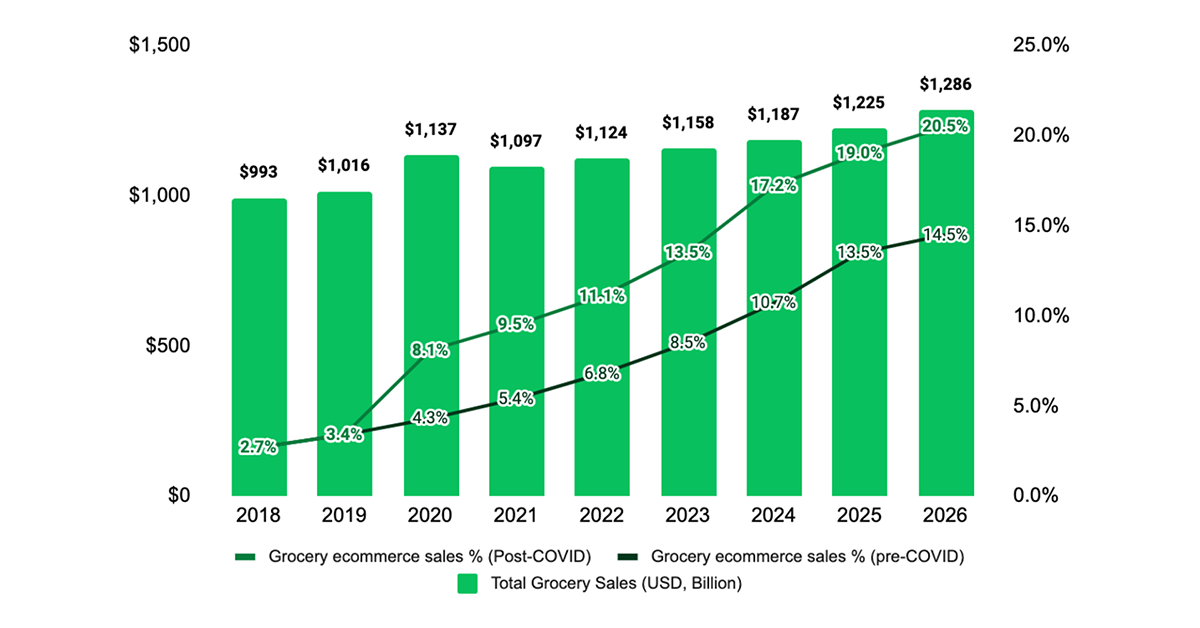

Historically, growth in grocery retailing has always been glacial. As per the Incisiv-Wynshop Digital Grocery Study, the sales growth is 2.7% year over year, on average. In fact, in the last three decades, sales have grown more than 5% YoY, only once in 2011. In 2020, sales more than tripled the average annual growth to 9.5%! The main driver of this growth was attributed to the rise in digital sales, which were up by more than 5x over 2019.

As has been well documented, digital’s unexpected growth came as a result of the global pandemic that effectively shut down the world. However, people still needed groceries and other essentials, but with lockdowns and “shelter in place” orders, the only way to shop was online. This sped up the adoption of digital by new customers and forced grocery retailers to quickly implement and expand new capabilities (e.g third-party partnerships, curbside delivery, etc.).

This growth, however, has come at the cost of profitability. With digital projected to rise to 20% of overall sales by 2025, grocers will need to focus their attention on improving their digital execution.

Profitability of Digital Orders Remains Low

While there was an increase in online orders, whether in terms of average basket size or volume, most grocery stores, particularly those with less than a billion dollars in revenue, failed to profit. As a result, it’s unsurprising that 86 percent of grocery retailers are dissatisfied with the profitability of their online operations. The average gross margin for digital orders was barely 9% in 2020, according to the Incisiv-Wynshop Digital Grocery Study, and many retailers even lost money on their online orders.

Grocery retailing is difficult. It’s a complex business with low growth and meager margins. While the quick digital growth of 2020 was great for revenue (+9.5 percent), merchants lost 70 percent of their profit on online orders and became a step distant from their customers. According to this aforementioned analysis, grocery retailers will lose $14 million in gross margin for every billion dollars in sales in 2025, if the present sales and profitability patterns continue.

Digital Operations are Inefficient

In comparison to other retail divisions, grocery retailers’ digital operations were quite undeveloped prior to 2020. In 2020, they were pushed to their breaking point by a 5x increase in demand and the inclusion of additional fulfillment methods (e.g., curbside).

Fortunately, this expansion uncovered execution inefficiencies that are critical to increasing profitability: knowing where the goods are (inventory visibility), picking them efficiently (order picking efficiency), and sending them inexpensively (last-mile delivery).

According to the Incisiv-Wynshop report, order picking efficiency is at the top of the list, with 92 percent of grocery retailers dissatisfied with their order picking efficiency. To reduce fulfillment costs, food retailers will experiment with capabilities such as micro-fulfillment centers, automated picking solutions, and labor models during the next 24 months.

Continue to read the full article on Grocery Doppio.

With online grocery adoption accelerating, automated order picking is essential to e-grocery profitability. The Alphabot® System powers your automated store picking systems, dark stores, or “hub and spoke” distribution model. The Alphabot System will also automate micro-fulfillment center replenishment at less-than-full-case levels, dramatically increasing the number of SKUs each location can support. Learn how the Alphabot System makes e-Grocery micro-fulfillment implementation practical and cost-effective today, while providing a platform for the future.

2022 has been a challenging year for many retailers. Issues such as supply chain disruptions that have delayed shipments of inventory are preventing retailers from setting their stores up with the products customers want most. Many retailers are facing a situation of having too much of the wrong inventory (paywall). Even large retailers like Walmart and Target are reportedly struggling with too much of the wrong inventory. Target reported that its inventory increased 43% in the last quarter.

Arguably, one of the retailers that has been impacted the most in 2022 is Amazon. According to the Wall Street Journal (paywall), Amazon acquired a lot of space at warehouses and distribution centers but is now subleasing some of that space after reporting slow growth in April. Now, there are signs that the “Next Big Thing” at Amazon may be automated micro-fulfillment centers. For example, Amazon Robotics has begun advertising for specialists to lead the development of Amazon’s next-generation micro-fulfillment solutions. By serving customers “at the point of need,” as some job descriptions explain, Amazon will likely be able to fulfill orders quickly and with precision.

Micro-fulfillment is a strategy that places small-scale warehouse facilities in densely populated urban locations closer to the consumer to improve delivery times.

In my opinion, micro-fulfillment is the best way for brands to bypass the use of retail stores or expensive fulfillment services by shipping their inventory direct to micro-fulfillment centers located in cities across the U.S. Then they can pick, pack and ship orders within minutes or hours depending on the service-level commitment they made to the customer.

But I believe micro-fulfillment isn’t just the next big thing for Amazon; it’s also the next big thing for retail.

I am considered a leading expert on the topics of supply chain management, logistics, e-commerce and micro-fulfillment. In 2013, I designed one of the first automated micro-fulfillment centers (MFC) for use inside a retail store. A micro-fulfillment center (or MFC) is a small, sometimes highly automated fulfillment center that can fulfill e-commerce orders as well as local store pickups.

MFCs may be located in an existing store or warehouse or a dedicated small distribution or warehouse space. MFCs can also be opened inside retail stores. Walmart is opening automated MFCs from the company Alert Innovation inside select Walmart stores.

Read the full article on Forbes

Alert Innovation Opens New Headquarters to Meet Customer Demand

Company is moving to larger facilities to accommodate rapidly growing workforceANDOVER, MA – Alert Innovation, a leader in grocery automation and micro fulfillment systems, is moving to a much larger space to accommodate the rapid expansion of its business. The new headquarters, located at 165 Dascomb Rd, in Andover, MA, includes about 70,000 sq. ft. of office space and 30,000 sq. ft. of lab space. Approximately 75% of the company’s 450 associates will be based in the new location.

“Our offices in North Billerica served us very well as we launched the company and started to deploy our suite of automated fulfillment solutions. Now that we’re in a phase of rapid deployment and team growth, we need more room for our engineers and operations team to efficiently take us to the next level,” said John Lert, Founder and Executive Chairman, Alert Innovation.

The new location opened today with a ribbon cutting ceremony and featuring addresses by Alert Innovation and local government officials, including Massachusetts State Senator Barry Finegold, Representative Tram Nguyen and Representative Frank Moran. At this new facility, Alert Innovation is constructing the patented Alphabot system – a cutting-edge robotic solution for grocery automation that is currently being deployed in major grocery retail spaces throughout the US. The new lab will serve as an engineering hub and center of excellence for developing new technologies in automation.

“It’s critical to have the space for our team members to not only meet our obligations for current deployments but also to develop future versions of the company’s solutions. The new headquarters is ideally located to attract great talent in the Boston area, plus it allows for future growth,” said Fritz Morgan, CEO, Alert Innovation.

Alert Innovation continues to hire in all areas of the organization including software, hardware, systems engineering and more. Click here to view all open roles.

About Alert Innovation, Inc

Alert Innovation® is a thought leader in grocery automation, driving innovation that improves lives by transforming how retailers operate and people shop. Alert Innovation is an industry leader in robotic e-grocery fulfillment. The Alphabot® system, designed by the Alert Innovation team is a unique automated fulfillment solution that utilizes patented omnidirectional robots in a temperature-controlled system for fresh, efficient, and high-quality grocery fulfillment. Alert Innovation also designed the Novastore™, a store concept utilizing the Alphabot system, delivering a dynamic and efficient shopping experience. www.alertinnovation.com

Media Contact:

Cristina Rodrigues

Alert Innovation

cristina.rodrigues@alertinnovation.com

+1 401.529.4980

By John Lert

Not that long ago—before 2017, in fact—the idea of robots picking orders inside local supermarkets instead of customers would have seemed a fanciful and distantly futuristic concept. Now, it’s beginning to seem like a logical next step in the evolution of food retailing, with far-reaching implications for the retail and CPG industries.

First, a quick look back.

Grocery shopping underwent a radical change about a century ago when Clarence Saunders launched Piggly Wiggly, the first successful operator of “self-serving” food stores, where there were no clerks or counters between the customers and the products. Customers collected their own items in hand-carried baskets and then went through a checkout station to pay for them, enjoying the 20% reduction in prices due to improved operating efficiency.

Shoppers preferred self-service over clerk service because it provided direct access to product information and prices, enabling them to make purchase decisions at their own pace. This led to a rapid shift to the self-service model, which transformed not just food retail but eventually all of retail.

The next evolutionary leap in shopping occurred when King Cullen opened the first modern-day supermarket, combining a dry-grocery section with produce and meats and much more over time. By aggregating food shopping and saving the customer time, this innovative format quickly came to dominate food retail and still does, with practically every modern supermarket featuring a “center store” selling packaged goods and “perimeter departments” selling fresh goods.

While these two “markets” are conveniently available to shoppers under the same roof, the customer experience when shopping them is very different. The key difference derives from the fact most individual center store SKUs are identical, which is not true of fresh goods.

For example, a customer may spend time in the store evaluating which brand, size or variant of ketchup to buy, but once that decision is made, almost no time is spent selecting which specific bottle to buy. Why would they – they’re all the same. In the fresh market, by contrast, customers spend time selecting not only which products to buy, but also—because they are not identical—the specific unit of each product, often with great care.

Continue to read the full article on CPGmatters

Download this new report, “E-Grocery Infrastructure 2022”, from STIQ (Styleintelligence) which provides and in-depth analysis of central and micro fulfillment centers, in-store technology and last mile technology.

by John Hennessy

Supermarket retailers are faced with a huge labor challenge. The explosion of ecommerce is amplifying this by creating the need for more order pickers, whether store employees or third-party providers, to manually fulfill e-grocery orders from stores.

Grocers are taking several approaches to address the issue. The initial goal is to improve manual order picking speed and accuracy. What worked when ecommerce order volumes were low no longer handles the larger volume of ecommerce orders being fulfilled today.

To get more orders out of the same headcount, retailers use a combination of technology, process improvements and sometimes shelves in the back of the store with fast-moving inventory that’s dedicated to filling online orders. Each of these steps can help retailers move toward achieving pick rate targets of 65 to 75 items per hour.

But pick rate improvements only solve part of the problem. There remains the issue of overcoming shopper dissatisfaction with substitutions and out of stocks. Compounding this is the challenge of picking orders from a dynamic inventory of live store shelves that makes it difficult to know what’s in stock.

As e-grocery volumes continue to increase, some retailers have started adding automated systems to further reduce labor and improve order accuracy. Current systems on the market can provide a variety of functions, including storing items, picking orders, handling store-picked orders and dispensing orders across ambient, refrigerated and frozen products.

Continue to read full article on Retail Wire.